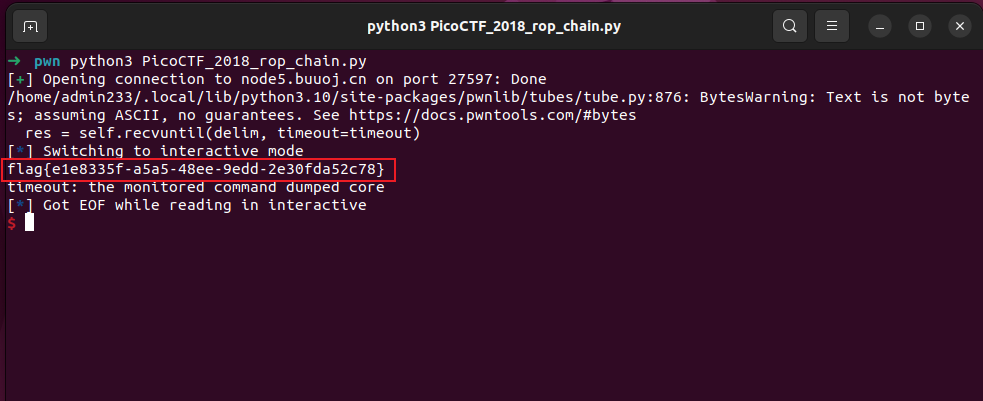

DeepSeek 2025 Stock Trends, Predictions & Insights

Introduction

DeepSeek, one of the trailblazing innovators of AI technology, has recently caught the interest of news sources due to its groundbreaking innovations and untold influence on the market— a market where it is not directly traded, but its related stocks and the broad market share significant movements as a result. This piece takes a close look at the trend and forecast of the price of DeepSeek stocks in 2025, its thematic stocks, and the opportunities it harbors for Investments in 2025.

DeepSeek’s Market Influence

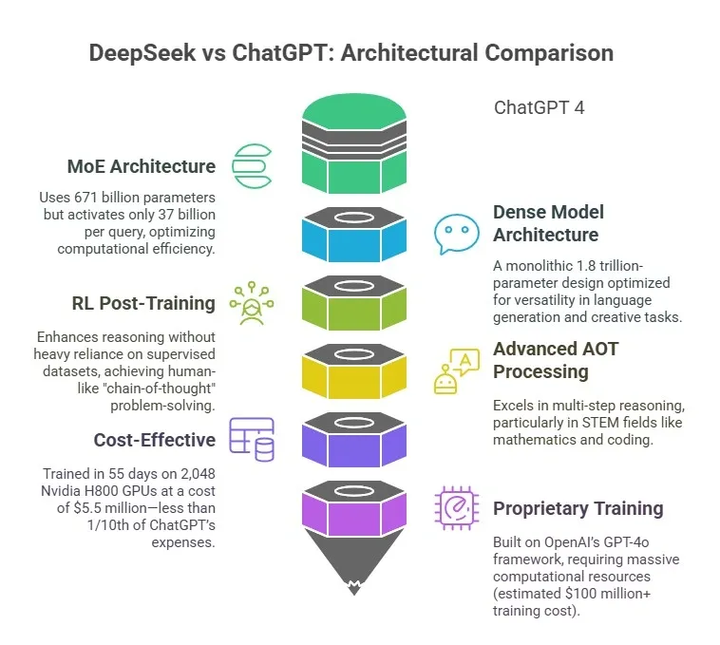

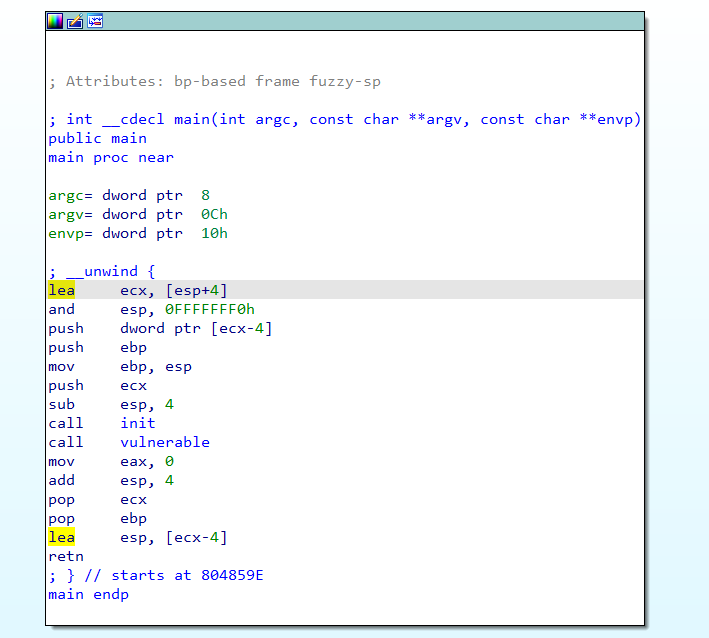

DeepSeek’s leading-edge AI, DeepSeek-V3 and DeepSeek-R1 drive changes in industries spanning finance through healthcare. While DeepSeek does not have a direct stock symbol, significant activity in “DeepSeek concept stocks” has occurred on the back of its technological advances. Stocks related to AI, cloud computing, and semiconductor technologies boomed, and they extend growth resulting from influence by DeepSeek.

DeepSeek Concept Stocks: Key Performers

Several stocks linked to DeepSeek’s ecosystem have experienced notable price surges:

- Meitu (美图公司): Shares rose nearly 20% in January 2025, driven by its association with DeepSeek’s AI innovations12.

- Kingsoft Cloud (金山云): Gained 16% as investors flocked to AI-related cloud computing stocks12.

- SenseTime (商汤): Increased by 11%, reflecting growing confidence in AI-driven technologies12.

These stocks highlight the market’s enthusiasm for DeepSeek’s technological breakthroughs and their potential to reshape industries.

DeepSeek’s Role in Market Predictions

The AI models developed by DeepSeek have also proved successful in forecasting market trends. As an example, DeepSeek predicted a 14% increase in gold prices to $3,200 per ounce by the end of 2025 as a result of various measurements including central bank demand and geopolitical risks2. These predictions have strengthened investor confidence both in DeepSeek’s analytical capabilities and the broader impact of much of it on the market.

Investment Opportunities in 2025

Investors looking to capitalize on DeepSeek’s growth can consider the following strategies:

- Focus on AI and Cloud Computing Stocks: Companies like Meitu and Kingsoft Cloud are well-positioned to benefit from DeepSeek’s advancements.

- Monitor Semiconductor Stocks: DeepSeek’s predictions for the semiconductor industry, including trends like advanced packaging and AI-driven testing, offer lucrative opportunities19.

- Diversify with ETFs: AI-focused ETFs, such as those tracking港股科技ETF, have shown strong performance due to DeepSeek’s influence.

Challenges and Risks

While DeepSeek-related stocks offer promising returns, investors should be aware of potential risks:

- Market Volatility: Rapid price movements in concept stocks can lead to significant fluctuations.

- Cybersecurity Threats: DeepSeek’s models have faced cyberattacks, which could impact associated companies2.

- Regulatory Changes: Evolving regulations in AI and technology sectors may affect market dynamics.

Conclusion: The Future of DeepSeek Stock Price

While DeepSeek is not a publicly traded entity, its impact on the stock market can not be contained. Because of this, DeepSeek is a leader in AI sectors driving growth and providing accurate market predictions that will act as catalyst in generating the investment trend for 2025. The information could be useful to investors looking to stay ahead of the curve and capitalize on the growing prominence of AI technology.

Call to Action:

Stay updated on DeepSeek’s latest developments and market predictions by visiting DeepSeek’s official website or following verified financial news platforms.