How to Buy Unitree Stock A Comprehensive Guide

This guide provides a concise overview of how to invest in Unitree Robotics, a leading company in AI-powered robotics. Follow these steps to explore pre-IPO investment opportunities.

Understanding Unitree’s Market Position

Unitree Robotics is a key player in the robotics industry, with 50% of its sales coming from international markets. The company is known for producing high-performance, cost-effective quadruped and humanoid robots, making it an attractive investment opportunity.

How to Invest in Unitree Stock

1. Accredited Investor Status

Unitree is a private company, and its shares are typically available only to accredited investors. To qualify, you must meet one of the following criteria:

- Net worth of at least $1 million (excluding primary residence).

- Annual income of $200,000 (or $300,000 with a spouse) for the past two years.

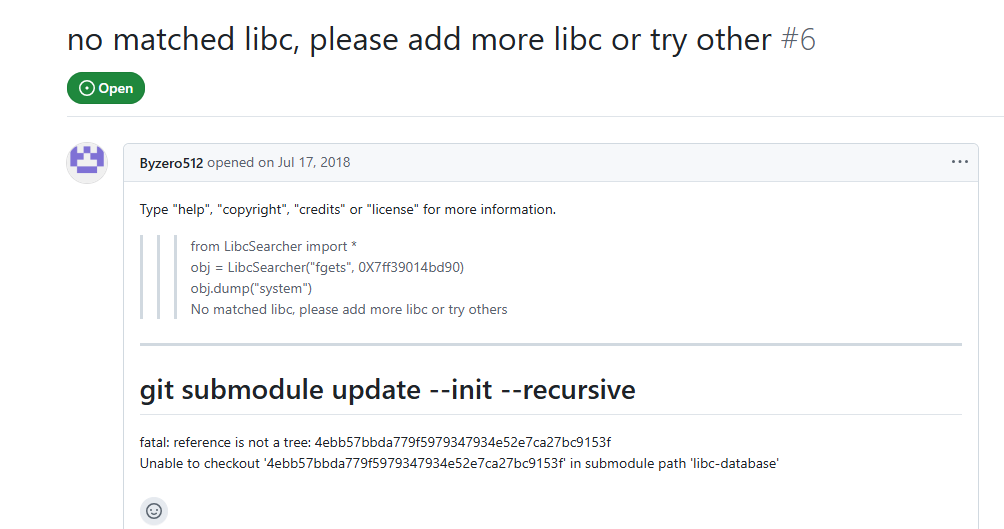

2. Use Equity Platforms

Platforms like EquityZen allow accredited investors to purchase pre-IPO shares from existing shareholders (e.g., early employees). These platforms provide:

- Detailed company financials.

- Valuation and risk analysis.

- Access to private market investments.

3. Investment Funds

Consider investing through funds that focus on pre-IPO companies. These funds pool capital from multiple investors, offering diversification and reduced risk compared to direct investments.

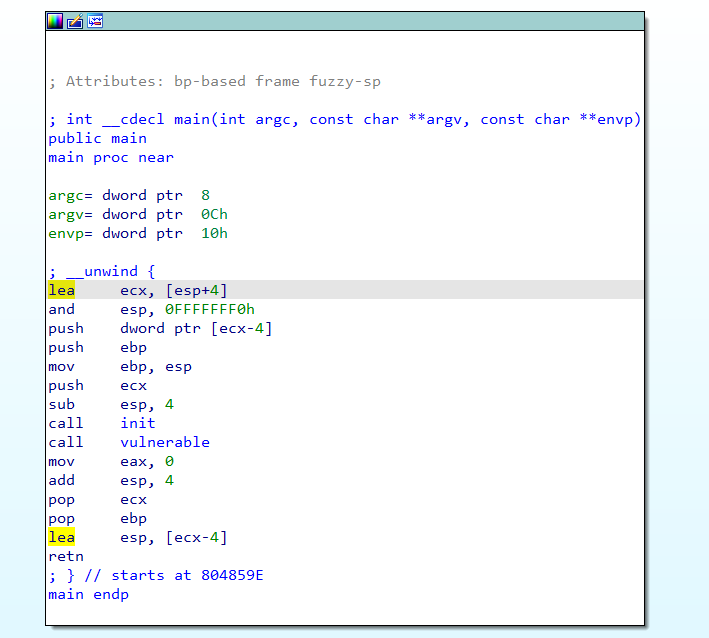

Steps to Buy Unitree Stock

Step 1: Verify Accreditation

Sign up on a platform like EquityZen and complete the accreditation process. This typically involves submitting financial documents (e.g., tax returns, bank statements).

Step 2: Research Unitree

Review Unitree’s financials, market position, and growth potential. EquityZen provides access to:

- Cap tables.

- Funding history.

- Business model insights.

Step 3: Place Your Order

Once verified, place an order for Unitree’s pre-IPO shares. The process includes:

- Compliance checks.

- Documentation submission.

- Payment processing.

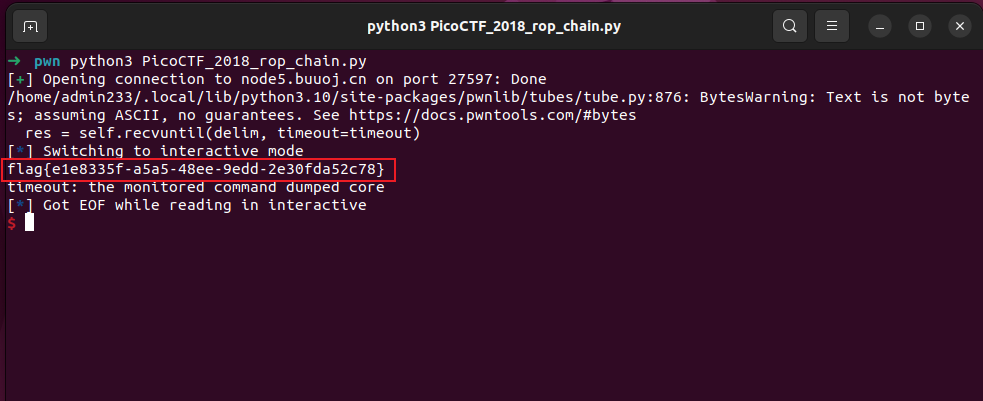

Step 4: Monitor Your Investment

Track Unitree’s progress, including:

- Product launches.

- Funding rounds.

- Market adoption.

Exit Strategies

1. IPO or Acquisition

If Unitree goes public or is acquired, your shares can be liquidated on the public market.

2. Secondary Market Sales

Platforms like EquityZen offer options to sell private shares to other investors through their secondary market.

Tips for Successful Investment

- Diversify Your Portfolio: Spread investments across multiple assets to manage risk.

- Stay Informed: Follow industry news and Unitree’s updates to stay ahead.

- Focus on Long-Term Growth: Unitree’s cost-effective robotics and R&D capabilities suggest strong future potential.

Conclusion

Investing in Unitree Robotics offers a unique opportunity to capitalize on the growing robotics industry. By using platforms like EquityZen and ensuring you meet accreditation requirements, you can access pre-IPO shares and potentially benefit from the company’s growth. Always conduct thorough research before investing.